Amount Due to Director

Soon Soon obtained director loan of RM 150000 on 1 April 2019 where the interest rate of the director loan from the company is fixed at 5 a year where it is due at the end of the month. CASA FOREST BIO WOOD MANUFACTURING SDN.

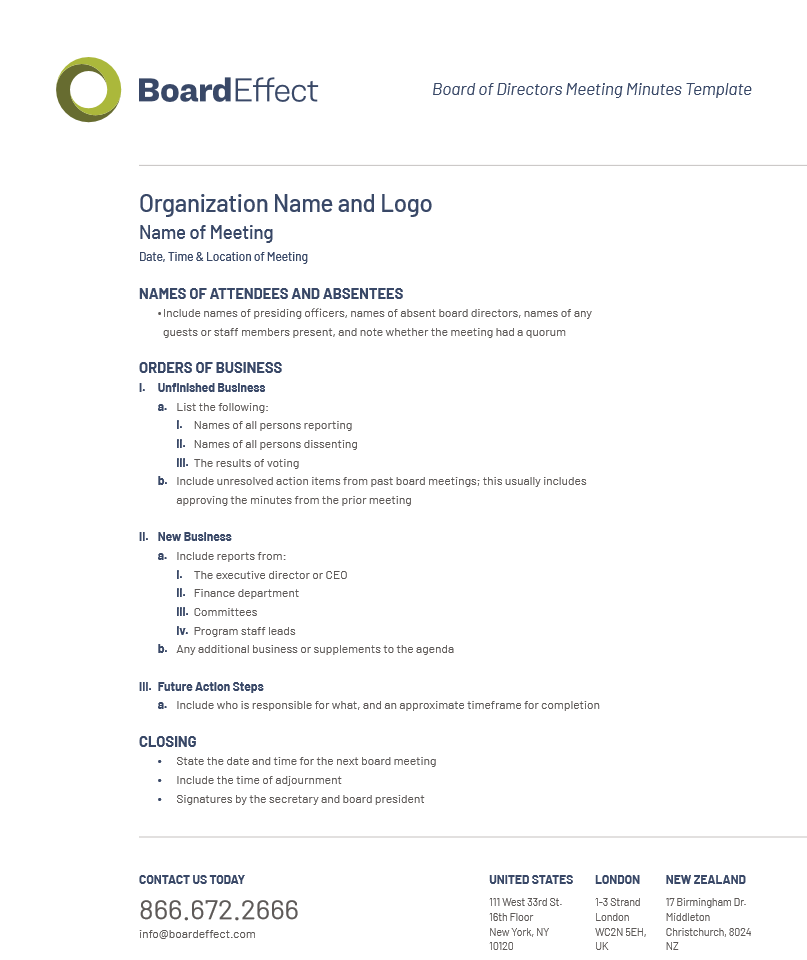

Board Meeting Minutes Template Board Minutes Best Practices

1 Home DR Home CR Home Balance BALANCE.

. There is documentary evidence that the loan is provided to the borrower in their capacity as a shareholder. Textbook Solutions Expert Tutors Earn. If i wanted to take out some cash for the director to pay for expense like gas and item that need cash payment first where should I categorize this section.

The best way is to establish an account under Cash accounts. Tut March 20 2016 1225pm 2. AMOUNT DUE FROM DIRECTOR - TAX IMPLICATION IN MALAYSIA.

Due To Account. The advance is unsecured interest free and has no fixed terms of repayment. The due to is used in conjunction with a.

The amount that is due from customers is also referred to as Accounts Receivable. Yang March 20 2016 1116am 1. The balance of due to a director represents the amount due to a director of CTGH for his loans to CTGH.

Credit card sales on July 8 2016 amounted to 12000 and were subject to a 25 bank feeUse this information to. Amount Due Meaning. Amount due to Director.

ABC Sdn Bhd gave an advance to a company director of RM100000 on 1 January 2014. Financial Statements 101 How To Read And Use. This is because the company has already serviced this order in terms of processing the relevant goods and services.

Amount due to director in balance sheet. DUE TO A DIRECTOR. A liability account typically found inside the general ledger that indicates the amount of funds currently payable to another account.

You pay a credit card statement in the amount of 6000 and all of the purchases are for expenses. In laymans terms if your Company has Amount Due From Directors you have to calculate an interest income for the Company based on the outstanding amount and Average Lending Rate ALR by Bank Negara Malaysia BNM and disclose it in your Audited Financial Statements as Interest Income and. That means that you have nine months after 31 st March to pay back the 30000 that is 31 st January 2021.

Thereafter you can enter the above journal entry. View Amount due from directorpdf from ACCOUNTING BBSA4103 at Open University Malaysia. Generally it is due immediately but it can be paid later in some instances.

Historically 25 of credit sales are uncollectibleAlpha Company uses the percentage of sales. Amount Due From Directors - Pay Income Tax. The company director holds 20 of the ordinary share capital of the Company.

AMOUNT OWING TO DIRECTORS The amount due to directors are unsecured interest-free and have no fixed term of repayment. The director made repayment of RM20000 in June 2014 and fully settled the advance by 31. Due to the relationship between a director or shareholder and the company any loan from a director or shareholder to the company can be interest-free.

Credit that is due from customers is considered to be a current asset. Amounts due to the director from the company should be recorded in the companys books as a creditor while the amounts due from the director to the company should be recorded as a debtor. AMOUNT DUE TO DIRECTOR Date Journal Type 01-01-0001 Ref.

The current portion of long-term debt is the amount of principal that must be paid within 12 months of the balance sheet date. AMOUNT DUE TO DIRECTOR SHRAN AMOUNT DUE TO DIRECTOR SHRAN INV032017 BANK from ACCOUNTING 201311153 at Adamson University. A due from account is an asset account in the general ledger that indicates the amount of deposits currently held at another company.

It is the basis for modern bookkeeping. The due from account is typically used in. If the loan does not exceed 5000 in the.

As it relates to the seller of a good or service the amount due is the total cost of the good or service including taxes and other surcharges that may be applicable. DEFERRED TAXATION The annexed notes form an integral part of these financial statements. View solution in original post.

Amount due to director. For the fiscal year ended December 31 2016 Alpha Company had credits sales that amounted to 300000. The amount due is unsecured interest free and has no fixed term of repayment.

He repaid RM 60000 to Krunch Sdn Bhd on 1 May 2019. But on 1 October 2019 he obtained RM 30000 in interest-free director loan from the company. The amount should also not depend on the position of the borrower in the company.

1100628-TIncorporated in Malaysia 14 NOTES TO THE FINANCIAL. In laymans terms if your Company has Amount Due From Directors you have to calculate an interest income for the Company based on the outstanding. This is the representation of the debtors that the company has at a given.

By the Company Without Cause or Resignation by. Due From Account. The loan amount benefit in kind calculation and interest payments should still be shown on the form P11D.

A due from account is an asset account in the general ledger that indicates the amount of deposits currently held at another company. It is generally inserted at the bottom of a bill. You can click on the Plus icon followed by Journal Entry.

Hence we have present value the amount due to Director at zero value. Termination Due to Executives Death. Due to Death or Disability.

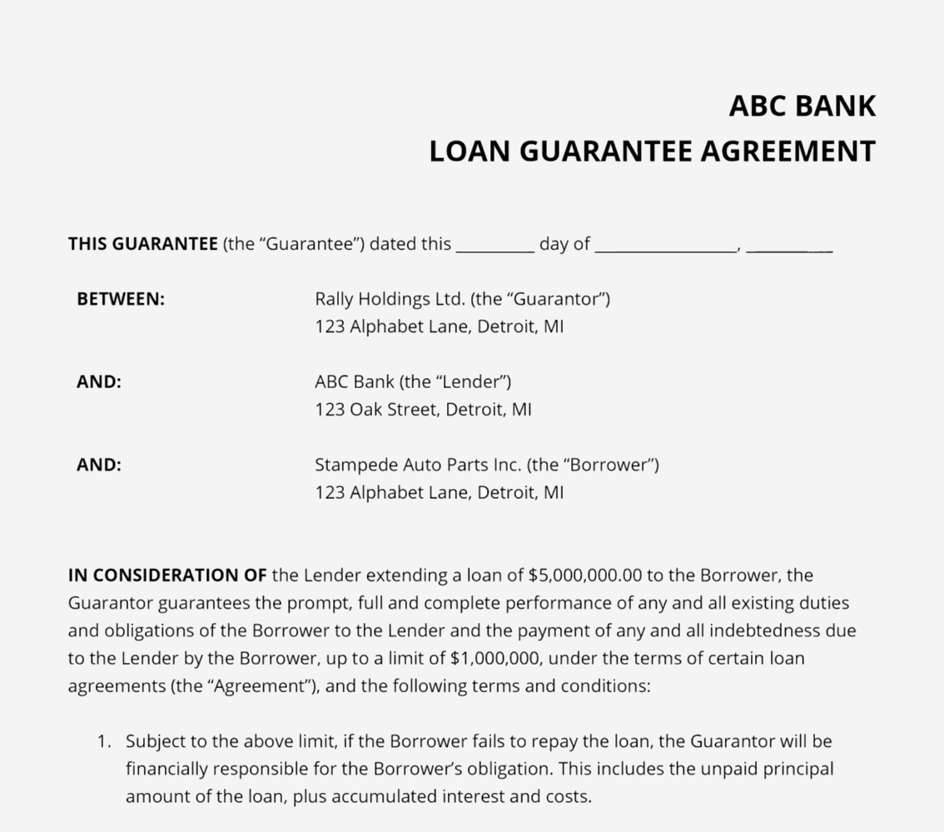

Corporate Guarantee Overview Types And Example

14 Free Progress Report Templates Ms Word Excel Pdf Formats Progress Report Template Progress Report Report Template

Payment Reminder Email How To Write 24 Samples

Sample Consultant Invoice Templates Consultant Invoice Template Consultant Invoice Template Save It Invoice Template Invoice Template Word Invoice Example

:max_bytes(150000):strip_icc()/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)

Comments

Post a Comment